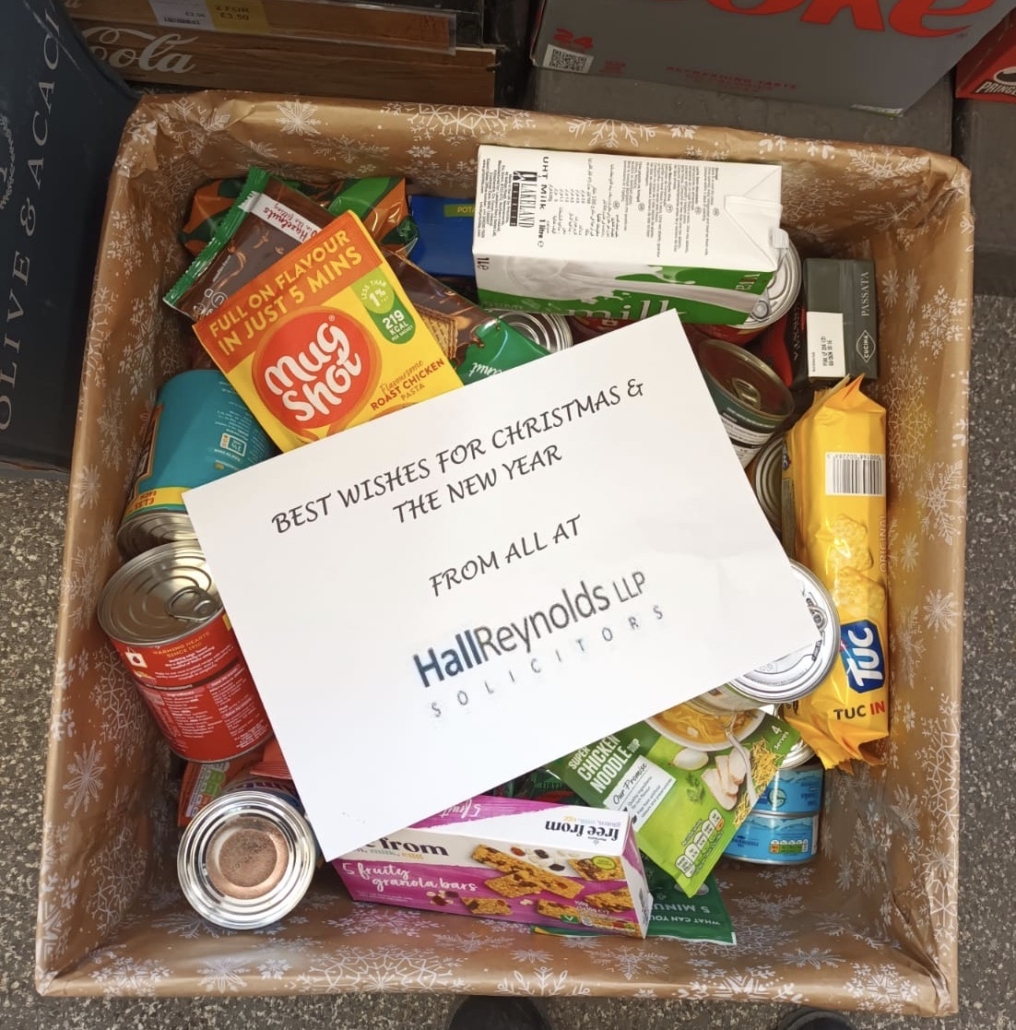

Each Christmas the Hall Reynolds team organise a food collection box at the office in Bidford-upon-Avon. The team are aware that not all families have the money spare for the luxuries most of us take for granted over the Christmas period, and due to the current cost of living crisis, many families are struggling to afford the basics.

The food collected was donated to the foodbank in Stratford-upon-Avon. The amazing team at the foodbank support around

- 480 people each month

- 36% of the parcels in 2023 were for children, which is a staggering increase of 47% from 2013

- The foodbank is part of The Trussell Trust’s network of 428 foodbanks, working to tackle food poverty and hunger in local communities, as well as across the UK

- The Foodbank Network was founded in 2004 after four years of developing the original foodbank based in Salisbury. Since then The Trussell Trust has helped communities work together to launch foodbanks nationwide in a wide range of towns and cities

- In 2022/23, food banks in the Trussell Trust’s network provided 2,986,203 three-day emergency food supplies and support to UK people in crisis. Of these, 1,139,553 were distributed for children

“We just wanted to write and thank you so much for organising the food collection for the Foodbank and for bringing it all down to us on 8th January. It was so thoughtful of you to think of us as beneficiaries as a local charity – thank you so much.

As you can see the foodbank is very much needed so we feel extremely fortunate with all the support we receive from so many businesses, individuals and groups.

We are all facing very difficult times one way or another and are grateful that you have thought of the Foodbank.”

Sarah Crompton, Assistant Manager and Operational Lead

Conchi Palacois delivered the food collection on behalf of the team

Hall Reynolds is an active member of the local community in Bidford-upon-Avon, supporting the Foodbank along with other local charities.

“We appreciate that a food donation box is a small gesture but trying to help make other people’s lives even a little bit better is something which I and my colleagues feel is important. Helping those in our community when they need it is something we all feel strongly about and are pleased the collection will help to do this.”

Katy Taylor, Partner, Hall Reynolds

Who are Hall Reynolds?

The team at Hall Reynolds are experienced and committed to providing first-class legal services. Our clients come back to us time and time again because of the pragmatic advice and the service they know they will receive which is delivered in a friendly and approachable manner.

We offer a traditional face-to-face service, a contemporary work ethos and modern operating systems which enable the swift progression of your transaction.

Value for money, speed and efficiency are at the heart of everything we do. Where possible, we minimise the legal jargon. We promise to keep you updated as to the progress of the transaction and we are transparent when it comes to fees.

To find out more about our community involvement or our legal services, contact the team to make an appointment – email@hallreynolds.co.uk or call us on 01789 772955.